FED Is A Game-Changer: ROTATION Begins, New Leadership Emerges

- May 30, 2016

- 6 min read

It started a few weeks ago with the release of the minutes from the April FED meeting showing a desire to hike rates again in June (if the economy allowed). Couple that with a Goldman Sachs downgrade on US equities (valuation), and Bank of America calling for a possible “summer swoon” (geo-political events & headlines), and investors are rethinking the investment thesis they have been following for 2016. Another rotation has begun in this “rolling bull market” and it is a positive development as the market was in need of new leadership which is now emerging.

I want to go back and see how the sector leadership for 2016 developed before I describe the rotation that is occurring. We started out the year with US equity markets having a fairly severe downturn. The Fed had already hiked once, oil prices were weakening, and the dollar was strong. We had been in an “earnings recession” but now there was real talk of an economic recession. Through this volatility there was a natural flight to safety in the US involving Consumer Staples, Utilities, Telecom, Bonds, and Gold. These sectors/instruments outperformed and were the go to vehicles for investors looking to hide. Bonds in particular did well, with the yield on the 10Yr reaching an intraday low of 1.55% after starting the year well above 2%. Gold was having its best quarter since 1986. The malaise continued until a trifecta of positive events occurred and the market bottomed. First, oil prices hit a low of $26 and then began to rise. The strong $US which had been a drag on overseas earnings started to show signs of weakness as it broke below its long-term range (See Chart). Most importantly, the FED became more cautious and investors thought them to be sidelined until Fall’16. Stocks rallied strongly on these developments and approached new highs once again. A new rotation occured as some money came out of those safety plays and into Energy, Materials, and Industrials stocks which benefitted from the strong oil/weak dollar paradigm.

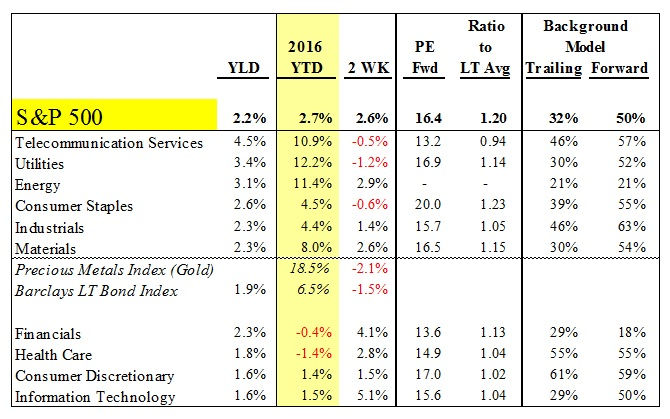

Another macro consideration has affected the direction of investments this year; the search for yield. Last year was all about growth. Growth was hard to find, so reliable growth stocks such as FANG (FB,AMZN,NFLX,GOOG) were bid up. This year it is all about yield and dividends. With the collapse of the 10yr rate, investors had to look elsewhere. The new FANG became Consumer Staples like food, soda and soap stocks coveted for their ability to produce income. Corporate and high yield bonds came into favor as well. Gold continued to show strength as an alternative to the negative interest rate environment that exists around the globe. Investors still held some of the high yielding safe haven plays like Utilities and Telecom. The table below shows the S&P 500 Gics Sectors (along with Bonds and Gold) with performance YTD. What you notice immediately is that the top performing sectors for 2016 all have the highest dividend yields (all above the S&P 500 yield of 2.2%). The lowest performers all have yields below the S&P 500 and US 10yr yld (all except financials). However, as the high yielding sectors came into favor, they were bid up and became very expensive on a forward valuation basis. The table includes the Forward P/E for each sector along with this ratio to its long term average (above 1, means the sector is “expensive” relative to its historical avg, below 1 means “cheap”). The top performing sectors as a group are close to a 17 PE(F) while the bottom performers are at around 15x next 12mth estimated earnings. Also, Staples, Utilities and Materials are the most expensive based on historical valuations.

Which brings me to the main point that the investment strategy and allocation that has worked for the first part of 2016 has played out and a rotation has begun into what so far have been underperforming groups. Obviously, valuation plays heavy into this notion; there is just no further for these dividend sectors to go based on fundamentals. But even more to the point is the backdrop that has benefitted these stocks is now in flux. The dynamic that took us from the bottom earlier in the year was predicated on rising oil, a weak $US, and dovish FED and the hope that earnings would finally arrive. While oil is still rising and sits near $50, the dollar has strengthened and is now back in its long-term range (see first Chart). Earnings season for Q1 was not great even when considering the low bar that was set; we may still be in an earnings recession. Finally, most importantly, the FED is being more aggressive which has caught many off-guard. Yellen was assumed to be protecting US manufacturers from global easing by leaving US rates alone for the time being. Those 2-3 Fed hikes that were taken off the table now have to be priced back in. Suddenly, investments in Consumer Staples and other groups that were made with lower rates in mind have to come to grips with a rising rate environment. It had been noted prior to the release of the FED minutes that Utilities were at the upper-end of valuation, Industrial stocks had negatives including slow top/bottom line growth, and there were recommendations to sell expensive Consumer Staples stocks in favor of Financials which will benefit from a rising yield curve (along with Tech). The table above already shows early signs of this shift. Looking at the sector performance for the past 2 weeks (since the FED revelations) and you can see weakness in the previous outperforming groups. Financials, Health Care, Cons Discretionary and Tech have been benefiting, and I think this trend will continue. Both Consumer Discretionary and Healthcare are relatively cheap and have consistently delivered on earnings. Technology is cheap and will do fine in rising rate environment. It had a disappointing earnings season but will benefit as investors switch from value to more growth oriented names. Financials have issues, but they will be very profitable once rates begin to rise. I think the Midcap Financials offer better opportunities given valuation and earnings outlook.

Back to the market as a whole. I think the S&P 500 is expensive at 16.5x forward earnings, especially in a tough earnings environment. Margins are flat and earnings growth is questionable. There will probably be 3% EPS growth with a 2% dividend leading to single digit returns. The S&P 500 still has not broken above the trading range established in late 2014/early 2015. The reality is that flat is the new up. But investors can do well by paying attention to the shifts in the market and owning sectors that make more sense based on fundamentals. The rotation that is happening now is a welcome change in leadership. How comfortable do you feel investing in a market being led by Utilities and Telecom? Now I do think Goldman Sachs has a point on its valuation downgrade. And Bank of America is acknowledging that much of the headwinds facing financial markets is coming from abroad. Eurozone potential growth is around 1% going forward given high unemployment and currency constraints. Japan will experience little to no growth given a shrinking workforce and failure of current economic policies. China is still a guess. The US will be stuck with 2-2.5% growth unless there is a boost in productivity and business investment. The IMF continues to downgrade global growth (as usual) but they have been right lately. You can avoid some of these headwinds if you stay with domestic companies who do most of their earning in the US. I think Midcap stocks have been doing better for a reason and I would look there for opportunities. This doesn’t paint a positive picture but I am not as negative on markets as others seem to be; there is a decent chance for upside surprise this year. In all likelihood, the economy will strengthen in the second half, earnings will improve, and the Fed will hike.

The last thing I would briefly like to touch on is bonds. Below is a chart of the Barclays LT Bond Index and the US 10yr rate. In 2015 the 10yr rose about 80bps (from 1.67% to 2.45%) in 5 months resulting in a 14% decline in the index. If the FED embarks on 2-3 hikes in the next 12 months, could this scenario repeat itself? I would be leary of fixed income instruments at this point as there is potential for a sharp decline. I think if something like this starts to happen stocks could benefit as money moves out of fixed income and into equities. Not a prediction, just a thought.

Comments